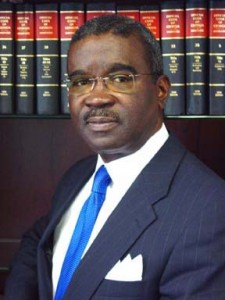

Arthur E. Ferdinand – Fulton County Tax Commissioner

June, 2010

– It is painful to witness the hard decisions some metro governing authorities face as they encounter significant budget shortfalls. The most troubling of these are the school boards, since austere measures precipitate both economic hardships for teachers and staff that lose jobs, and an academic crisis for the students whose educational development is threatened.

– It is painful to witness the hard decisions some metro governing authorities face as they encounter significant budget shortfalls. The most troubling of these are the school boards, since austere measures precipitate both economic hardships for teachers and staff that lose jobs, and an academic crisis for the students whose educational development is threatened.

Revenue for governmental services are dropping for a myriad of reasons in the metro area, including lower sales tax revenue, drop in building starts, and lower property values. In the case of property values, governing authorities can adjust millage rates to compensate for fall in property values but are unwilling to make such controversial measures in election years.

Fulton County is not having the same problems as other metro area in the 2009 fiscal year. It has a balanced budget without taking austere measures to achieve it. No personnel were laid off, no salaries were cut, and no essential services were curtailed.

At this juncture, Fulton County is on a pace to have a fund balance higher than established by law. This is so because we have collected property taxes that have already exceeded the anticipated tax collection rate, prior to the end of the fiscal year.

The county continues to benefit from high tax collection rates year in and year out, even in a bad economy as this is, to ensure a sound budget for essential services.

When it comes to your money, Tax Matters.

Fulton County Government Center

141 Pryor St. S.W., Suite 1085

Atlanta, Georgia 30303