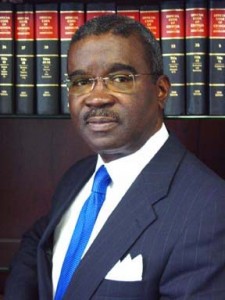

Arthur E. Ferdinand – Fulton County Tax Commissioner

April, 2008

– During the last nine years thirteen Tax Allocation Districts or TADs were created in Fulton County; ten in the City of Atlanta, two in East Point and one in the City of Alpharetta.

– During the last nine years thirteen Tax Allocation Districts or TADs were created in Fulton County; ten in the City of Atlanta, two in East Point and one in the City of Alpharetta.

The legislation authorizing the creation of TADs noted that economically and socially depressed areas contribute to or cause unemployment, limit the tax resources of counties and municipalities while creating a greater demand for governmental services. These under performing areas can have a deleterious effect on public health, safety, and morals.

When an area experiences growth and economic development, the value of taxable property in the area increases and so too does the tax revenue collected from properties in the area. TADs capture the incremental increase in revenue in the designated area to pay for cost incurred in rehabilitating and developing the area.

The definition of redevelopment costs is quite broad and includes any expenditure or monetary obligation incurred to achieve the redevelopment of the area designated as a TAD.

When a TAD is created within a municipality, each Governing Authority can authorize the use of property tax revenue increments to fund the development within the area. And according to the enabling legislation, this includes the county, city, and school district tax revenues. The commitment of tax revenues can be for twenty years or longer.

According to the Georgia Constitution, School Board revenue cannot be used for purposes other than education. And yet, since the inception of Georgia TADs Atlanta Board of Education tax revenues have been committed to property development. This use of school tax revenue was challenged in the case of the Beltline TAD and the Georgia Supreme Court affirmed that school tax revenue cannot be used to finance development.

Since the creation of the first TAD in 1999 a total of $124 Million dollars in tax revenue was diverted from the general funds of the City of Atlanta, Fulton County, the Atlanta Board of Education, and the Fulton County School Board to finance TADs. More than half of these funds came from the Atlanta Board of Education.

In 2007, $50.2 Million dollars in tax revenues went to TADs; of this amount $26.24 million was contributed by the Atlanta Board of Education. Currently, the President of the Atlanta Board of Education, which approves the diversion of school tax revenue to Atlanta TADs, is also a Board member of the Atlanta Development Authority which receives these tax revenues to finance the City of Atlanta TADs.

A bill passed by the 2008 Georgia Assembly seeks to amend the Georgia Constitution to allow the use of School Board revenue for purposes other than education. As with any amendment to the Georgia Constitution, you the citizen get to vote for the change in the General Election later this year.

Over 50% of the property taxes you pay are school taxes. And still many teachers provide school supplies out of their own pockets. QUITE FRANKLY, the question for citizens is: Do you want taxes you pay to educate your children, diverted to other uses?

You decide. Because when it comes to your money, TAX MATTERS.