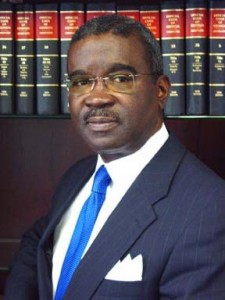

Arthur E. Ferdinand – Fulton County Tax Commissioner

Arthur E. Ferdinand – Fulton County Tax Commissioner

June, 2005

– As I traveled around the county on speaking engagements in recent weeks, I have encountered taxpayers who have expressed anxious concern that their property assessments were “too high,” leading to excessive property tax bills.

Three elements go into calculating your tax bill: your property value, your exemption, and the millage or taxing rate.

Your property value is determined by the Board of Assessors. If you believe you can sell your property for the value set by the Board of Assessors then it is a fair value and there really is no reason to appeal the assessment. However, if your valuation is excessive or unfair, then by all means, appeal to the Board of Assessors, and if necessary, to the Board of Equalization. Your exemption, also granted by the Board of Assessors, the second element in the tax calculation is basically fixed. It is what you are entitled to receive, e.g. regular homestead exemption, disability exemption, overage exemption, etc, etc, etc.

If your property valuation is fair, and your exemption is correct, then the only element you can really influence is the millage rate, set by the Board of Commissioners and other governing authorities like school boards and city councils.

Governing authorities decide how much is needed to operate effectively and provide services to the public. Using the digest, the total value of all property in the municipality or county as appropriate, and the value of all exemptions, a governing authority sets a millage or taxing rate that would produce the revenue needed to accomplish its goals.

Public hearings are held every year to give the public an opportunity to tell governing authorities what it thinks about spending priorities. The more a government spends the higher the millage rate. So by participating in that political process, property owners can influence spending and the millage rate, and in so doing, taxes as well.